What Business Does Lee Roberts Have as Chancellor of UNC-Chapel Hill?

For over a decade, proximity to power in North Carolina has enabled Lee Roberts to push for state investment in large-scale real estate projects—including those he and his associates have profited millions from.

Images: UNC-Chapel Hill / SharpVue Capital.

BY KEVIN DANKO | May 27, 2025

October 11, 2024: Lee Roberts places his left hand on the Durant Bible, North Carolina’s oldest book, swearing an oath to become chancellor of UNC-Chapel Hill.

October 18, 2024: Roberts and his business partners initiate the sale of $31 million in unregistered securities to 23 unknown investors.

Research and reporting from this story informed a section, “The Long View,” in The Assembly’s profile of Lee Roberts, embedded below, detailing his myriad conflicts of interest. Scroll window to view.

With every UNC milestone, a (SharpVue) shadow

Questioned about his activities as owner of SharpVue Capital, the private equity firm Roberts co-founded, UNC Media Relations and the UNC Public Records Office cut-and-paste the company line that “Roberts is no longer involved in the day-to-day operations of SharpVue and has not been since he became interim chancellor in January 2024.”

Roberts’s LinkedIn profile contradicts their timeline, with Roberts promoting that he continued to work with SharpVue through August of 2024—eight months longer than the university claims and the full length of his interim term.

“The [UNC] Board of Governors is saying, ‘We no longer need a full-time chancellor,’” scoffs Bob Hall, former executive director of Democracy NC.

No agreement exists between Roberts and UNC which establishes that he has stepped down from operating his company.

There’s a paper trail that shows he has not.

Gained $36 million in assets in first year as chancellor

According to documents SharpVue has filed with the Securities and Exchange Commission (SEC) and the North Carolina Secretary of State’s office, in addition to being “principal owner” Roberts remains “partner” and continues to serve as “executive officer” and “managing director” over his company, a firm that manages $354 million in assets as of March 31, 2025.

Subsequent annual filings from 2024 and 2025 show SharpVue gained $36 million in assets under management during Roberts’s first twelve months as chancellor.

“One of the chief roles of the chancellor,” explains Hall, “is to be the chief fundraiser.

“[Roberts is] being paid to interact with wealthy people on behalf of the university, and no doubt the Board of Governors also sees it as, he's making contact with rich people in his private life, and maybe that will help the university.”

Pressed as to why Roberts’s companies are still naming him as an executive and manager on company financials, UNC Media Relations responds that “[Roberts] and SharpVue often go above and beyond when reporting his involvement,” and assert that “he will continue to be included on any required [SharpVue] paperwork moving forward.”

While he may go above and beyond to report his financial activities with SharpVue to the SEC and the N.C. Secretary of State’s office, Roberts dramatically underreports his involvement to the North Carolina State Ethics Commission.

Hidden interest

Roberts’s annual salary as chancellor: $600,000, with potential to earn up to an additional 100% of his salary in bonuses.

As a public official with a taxpayer-funded salary, Roberts is required to file a conflict of interest form annually with the N.C. State Ethics Commission, naming all assets and outside income sources.

In 2024, Roberts registered no fewer than 30 companies with N.C. Secretary of State, with others in Delaware.

Roberts reported just ten to the State Ethics Commission.

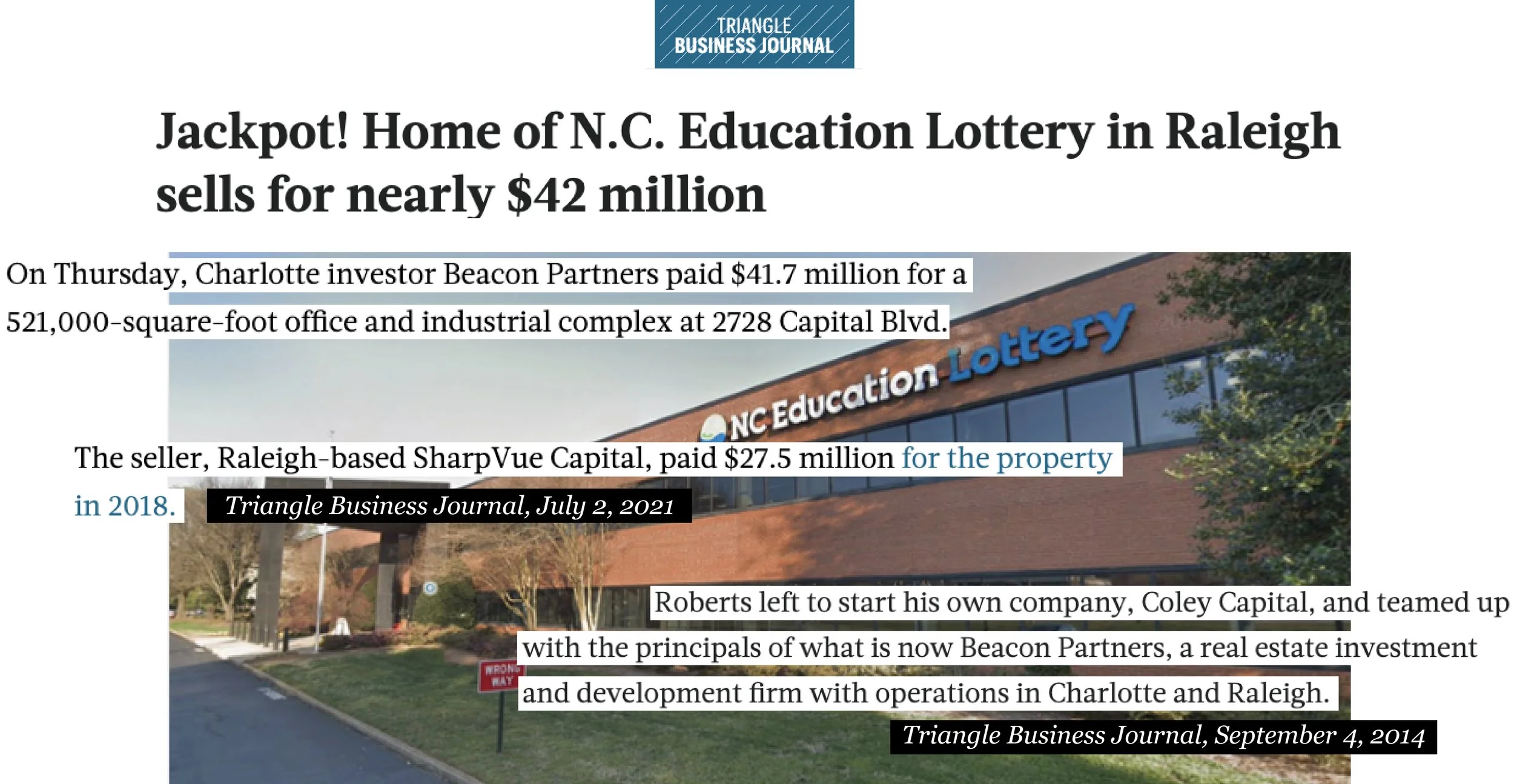

In selling N.C. Education Lottery headquarters, Roberts transferred ownership of the complex from one private equity firm he co-founded to another.

Private endowment meets private equity

In assuming the role as chancellor, Roberts joins the eight-member board overseeing UNC Management Company, Inc. (UNCMC)’s investment of the $11.5 billion UNC System endowment.

Between 2018 and 2023, UNCMC, the private corporation created to invest the UNC System’s endowment, increased its investment in private equity substantially, from 19.6% of total investment in 2018 to 32% of total investment in 2023.

Factoring endowment growth, this amounts to an increase of roughly $2 billion.

At the end of 2023, in Roberts UNCMC added a private equity firm principal to its exclusive board—comprised of Roberts; UNC Chapel Hill’s Board of Trustees chair, an ardent champion for Roberts’s election to chancellor; a major donor and hedge fund manager; the UNCMC president, who earned $1.8 million in bonuses alone in 2023, a year the endowment lost millions; one of Roberts’s subordinates at the N.C. State Budget office; and three members of the group’s choosing.

“All of that is really a recipe for corruption,” says Hall.

The double-deal repeal

As Roberts transitioned from interim to permanent chancellor at UNC, the UNC System repealed a quarter-century-old policy to curb double dipping by university executives.

The UNC System Office can’t explain why or how. No minutes from meetings, no agenda items, no communications show the policy as a topic debated or discussed—other than a red line of text on the policy itself.

“We have conducted an exhaustive search and have concluded that there are no written communications that would be responsive to why [the UNC System’s executive conflict of interest policy] was moved,” the UNC System Office responded, after several public records requests for any documentation regarding the repeal of the policy.

North Carolina Open Government Coalition director Pate McMichael questions the validity of the policy change, emphasizing that “unless I'm missing something, the procedures matter quite a bit, and someone has to institute that kind of change.”

The work agreement Roberts received from UNC System leadership two months following explicitly required Roberts to abide by the policy the same body had freshly repealed.

“There's an appearance of people playing the system for their own financial benefit,” McMichael states.

Chancellor without a résumé

Pelissero points to Roberts’s initial appointment to interim chancellor prior to his selection as permanent chancellor as part of a trend, where “schools will get around the formal process by appointing an interim and then naming the interim [to the permanent position].”

Roberts’s official UNC biography is sparse, a scant eight sentences in length. He does not have a résumé on file with the university.

“Universities especially have to be particularly cognizant of whether they are going to be able to legitimize the decision they're making in a leadership hire,” says Pelissero, “[if] the interim appointment [is] really just a way for the individual to get the full-time job when they may not be as qualified.”

Elected interim chancellor by the UNC Board of Governors while serving on the UNC Board of Governors, with no previous experience in academia, Roberts admittedly remained employed by an outside company, his own, for the length of his interim tenure.

“What could he have done to legitimately distinguish himself for that chancellor role?” questions Taylor Wells, a third generation North Carolina educator and UNC alumnus.

“That’s a big role that has historically been held by academic giants.”

Back to business as usual?

In an article in the Triangle Business Journal from December 2023, Robert’s SharpVue partner Doug Vaughn shared that “[T]here’s no plan for this to be anything but temporary, as [Roberts] and I confirmed with each other...[H]e should be able to slide right back in and we’ll continue to grow both sides of the business.”

Hall points to a pattern: that “[Roberts] moves from one position to another position, so his commitment to these various positions is short-term relative to his long-term financial interests, and he keeps building that long-term interest.”

Principal, chancellor, principles

Wells draws parallels from his eleven years in the classroom as a middle school and high school math teacher, challenging, “What is a ‘chancellor?’”

“That’s like a magical position. I guess the equivalent in a middle or a high school would be a principal. That’s a sun up to sun down job. My principles were busy! They didn’t have time to be scheming.”

A timeline of Roberts’s activities as both chancellor of UNC-Chapel Hill and principal owner of SharpVue Capital.

“Whether he is doing anything that’s necessarily illegal is besides the point,” says John Pelissero, former director of government ethics at the Markkula Center for Applied Ethics at Santa Clara University.

“He has an ethical duty to separate himself from any personal and financial interests that would potentially impact him positively while he’s serving in that leadership role at the university.”

State lease, state landlord

It’s not the first time Roberts, as a North Carolina public official, failed to disclose ownership of profitable assets to the N.C. State Ethics Commission.

While North Carolina state budget director in 2015, Roberts consulted on the 10-year, $14 million lease of 2728 Capital Boulevard, a 521,000 square foot industrial complex in Raleigh, to house the North Carolina Education Lottery—a lease which included a clause that would transfer the lease to a new owner if the complex were sold.

Roberts then left the State Budget Office to form SharpVue, within two years purchasing the building himself.

SharpVue received over $4 million in rent from the N.C. State Education Lottery between April 2018 and July 2021.

Appointed to the UNC Board of Governors in spring 2021 with his term to begin on July 1, Roberts submitted a required financial disclosure on which he omitted ownership of the complex.

He would sell the complex on June 30, less than 24 hours before joining the Board of Governors, profiting $14 million for SharpVue.

Hall expresses concern that Roberts “is learning about [opportunities] in his government position, and then [being] involved in the same assets in his private position, benefiting from that knowledge to invest.”

UNC Media Relations justifies the omissions, relaying that Roberts had only been “a minority investor in the fund” that is a “part of the LLC that handled the sale of the building,” and that he therefore had “no direct ownership.”

Gibberish.

Roberts formed four separate limited liability companies for the purchase, management, and sale of the complex, naming himself "Managing Member" of each.

The role of “Member” in an LLC signals ownership interest.

The N.C. State Ethics Commission requires officials and employees to list subsidiaries of companies they own interest in above $10,000.

His is the sole SharpVue signature on the deed of sale.

SharpVue earns money in two primary ways: management fees, typically 2% of a fund’s value—in this case, just under $600,000 annually—and share of profits, up to 20%, or $ 3 million.